In a world where we are witnessing almost daily stock market crashes, a dizzying growth of cryptocurrencies and NFT, the swinging prices of real estate and raw materials due to geopolitical events, it is pretty expected that the speculative frenzy would touch other fields as well.

And the world of watches represents a natural evolution, given that by now people are also "investing" in art, vintage cars and even barrels of whisky. So, let's see what is true and what is false about the much-hyped opportunities offered by investing in the magical world of timepieces.

Are Watches a Good Investment?

The answer may not be what you expect. First of all, technically, watches are not a real "investment," but more appropriately, a "shelter good." Like gold bullion, they represent an asset in which we accumulate a fixed value during our purchase at a certain level. And no one confirms to us whether this investment of ours will bear fruit or not. That is, whether we will earn more than we have spent, and if so, how much more.

That said, are manual-winding and automatic watches a clever way to store money? Or at least, better than others? The answer, again, will not please everyone: yes and no. Still, everyone must be wondering: but Rolexes have never stopped growing, and the recently discontinued Patek Philippe Nautilus 5711 has quintupled in value. And this is very true.

But alongside these cases - the tip of the iceberg - there are hundreds of others where certain watches have not increased in value at all but have lost it. So, it's not a matter of figuring out if watches are a good investment, but understanding which ones are and which aren't, as this varies by model, by edition, by year, and even by feeling. An example? Just think that the Rolex Daytona, today highly coveted, was for a long time the least requested watch in the entire Rolex range, so much so that in 1975 it was about to be withdrawn from production.

Watch Value

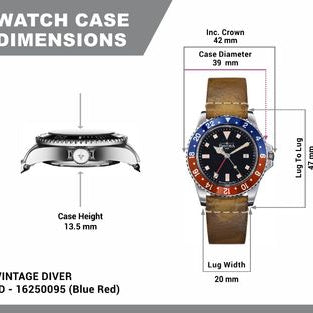

Therefore, we find ourselves considering the investment in watches according to a number of elements such as its initial cost, the number of timepieces produced (and therefore its relative rarity), its technical characteristics, the watch size, and so on.

In doing so, we are plunging into a world made up of infinite nuances, which determine the market value of the specific watch. As the example of Rolex shows us, this can be even higher than the list price due to the effects of the law of supply and demand. If there is little supply and a lot of demand, the price goes up.

And since the shop windows of Rolex dealers have been chronically empty for years now, this explains why you can't buy a Rolex Submariner unless it's about twice its list price. So, when you are asking yourself why are watches so expensive (at least, in some cases), please remember that.

What gives a watch value?

As we said, the value is assigned by the market and has nothing - or very little - to do with the technical characteristics or materials of the watch. A Rolex Submariner is not qualitatively very different from a Blancpain Fifty Fathoms. Still, if you go to a Blancpain dealer, you won't find it difficult to buy this wonderful timepiece at list price and probably, to walk out with the watch on your wrist.

Yet, this does not happen with Rolexes. Even though Rolex has a production that is enormously higher than Blancpain - by about 40 times - a Rolex timepiece is much more sought after. And this only depends on the strength the brand has on the market; even comparing it to a company that, in terms of history and exclusivity, is much more important than Rolex itself, at least on paper.

So why does Rolex have value and retain it more than any other brand? Because the market thinks it does. And until today, it has done nothing. Still, it confirms it, with prices that have risen dramatically, especially in the last 15 years, transforming Rolex watches from their original function of perfect "tool watches" into a luxury object, purchased for the prestige it represents, beyond its purely technical characteristics.

Do watches hold their value?

The best analogy we can find is perhaps that with the automobile market. Except in sporadic cases, all cars immediately depreciate by 50% during the first year of life. Their quotation then falls until it reaches a minimum value below which they do not go. Then, for different reasons, they can start to rise again when they become vintage - and this happens in particularly well-kept examples and possibly, belonging to a particular series where only a few were produced.

Similarly, watches typically fall until they reach a certain threshold, then stabilize, and eventually start to rise again, "pulled" by motivations similar to those that make car prices soar. For example, we are recently witnessing a polarization of luxury: luxury watches are becoming more and more luxurious, with the consequent loss of competitiveness of the segments that, until yesterday, were extremely popular, the so-called "affordable luxury ."And this is pushing more and more companies, even those historically aimed at more affordable markets, to increase their list prices to adapt to the market, something that Seiko, which has always been a standard-bearer of quality at the right price, is also doing.

And this is originating a momentum in the market, where prices, in general, are going up to accompany this sentiment - without, however, changing the underlying quality. Will these watches retain their value in the future? Let's keep in mind that the traditional mechanical watch is no longer a necessity but a voluptuary object (and this should settle the diatribe between regular watches and smartwatches): it is, therefore, possible that, generally speaking, watch prices are set to rise in the near future, and that even second-hand watches will maintain or increase in value.

Why do watches lose value?

There are many different instances why a watch can lose value, and one of the most common is the end of a fad. One of the most striking examples is the boom Swatch had during the Eighties and Nineties. These cute quartz watches had a formidable feature: they embodied the collecting instinct of people through inexpensive timepiece accessories that everyone could afford in quantity. And since some of these watches were produced in small numbers, this created the conditions for forming an enormous "speculative bubble," which sustained this phenomenon for several years.

Then, because of the massive amount of references and models published, the public started to get tired of Swatches. As a result, their prices began to sink until they reached the current level where most people are no longer interested in these watches, apart from very particular cases that represent the exception: the recent evaluation of a used Swatch is one-fifth of their cost in store.

In this particular case, the "bubble" that sustained the prices has deflated - but we must also remember that the technical characteristics of these timepieces are modest - something that can indeed not be said with the current "bubble" that concerns Rolex quotes.

As you can see, there are fashions in watchmaking. And when the fad passes, the quotes go down, sometimes dramatically. For example, Franck Muller watches were highly fashionable in the 1990s, but since the launch of Richard Mille, Franck Muller's clientele has switched to buying these other timepieces. With the result that today, Franck Muller watches are vastly undervalued in the second-hand market (and, in some cases, are a great buy).

How do you tell if a watch will appreciate?

If we knew, we wouldn't be blogging about it, would we? However, there are indicators - absolutely empirical - that can be applied to examine the trends of the markets of unique products such as luxury goods and are based on the analysis of the general movement of the market in relation to its past performance - a bit like what happens with the performance of stocks, currencies, and any other financial product that is traded in the markets.

In summary, marketplaces such as Chrono24 and Chronext publish historical performances of the average prices of certain particular timepieces. By evaluating these, one can trace the performance of the market - which, being composed of a mass of people, has a more or less pronounced momentum. The larger the market, the longer it will take to change direction (thus moving from a buying phase to a selling phase).

What are some characteristics that influence this trend?

- Brand - A watch from a famous brand will hold its value - or increase it - more than one from a little-known brand, regardless of its technical content. This means that there are brands that sometimes "speculate" on the strength of their brand to give their audience watches that are valuable, but that honestly could cost much less than their selling price. This applies to both the "top" and "bottom" tiers. As a result, many fashion watches are sold at relatively low prices, despite showing a famous fashion brand on the dial - or perhaps, for that very reason. And usually, those who buy them feel that they should maintain their value for this reason.

- Complications and materials - A complicated watch is a timepiece that incorporates unique features that are different from the regular features that you ordinarily find in a watch movement. And we are talking about astronomical complications, such as triple dates or perpetual calendars; time complications, such as chronographs and the like; sound complications, such as repeaters; shape complications, such as ultra-flat. In summary, the more a watch mounts interesting and unique mechanisms or has exclusive features, like a different material (like titanium vs. stainless steel) the more it tends to rise in value and keep it.

- Age - Talking in general, modern watches appreciate because they are made in small quantities - or better, little quantity vs. demand. Vintage watches do so because the more time passes, the less watches of that kind in working condition you're bound to find on the market. A typical example is military watches: assigned original field watches of WWII like authentic German Fliegers are costly because there are so very little left, not because they were that precious.

- Scarcity - the harder a timepiece is to find, the more its price will tend to rise. For example, MING, the Malaysian luxury watch manufacturer that won the Grand Prix d'Horlogerie de Geneve three years ago, produces an extremely limited series of timepieces - about 300 pieces per release - and when it publishes them on its e-commerce, it sells out within ten minutes. This also explains why several companies offer "Limited Editions" of their timepieces.

- Fashion and quirks - if a celebrity wears a specific watch (or as it happens with some of them, wears two watches or more) on the cover of a prominent magazine or during a famous occasion, its prices will instantly go up. For example, on a renowned cover from several years ago, Johnny Depp was pictured wearing a unique watch, the Juvenia Protractor, featuring curious hands in the shape of architects' instruments. Even though Juvenia was an ancient and respected Maison, but now practically disappeared, absorbed by a group from Hong Kong, the quotations of this watch were inflamed.

How to invest in watches?

To invest in watches, one must behave exactly as a "traditional" investor would, that is, make clear choices. And these concern the investment horizons. As you may know, there are different "profiles" in stock market investments. There are short-term investors, the so-called "day traders," and long-term investors - to quote a very famous one, Warren Buffett.

The former operates on the market continuously, chasing trends and bubbles - and trying to speculate on them (and remember, there is no negative meaning in this term). So, to make a practical case, they try to buy watches that are "bullish" right now, to put it in stock market terms and hope that their trend doesn't change. That is, they might buy a second wrist Rolex Submariner and try to resell it at a higher price a few weeks later, based on their perception of the market trend.

On the other hand, the latter tend to make few transactions and buy goods that are not in great demand at that moment but may soon become so. Indeed, if they are in a recession (the so-called "bearish" market), it is even better. So this kind of investor focuses on watches that are not fashionable but have the right characteristics to represent a good return in the future. In the case of watches, a stable price, an essential but undervalued brand, the presence of exciting complications. These investors are the ones who foresee market developments without chasing it - and so right now, they could buy watches from companies such as Girard Perregaux, Bulgari, and Piaget.

So, first, you have to find a profile and then operate within that profile to achieve your goals. And to do that, you have to develop knowledge and expertise of the watchmaking field that goes beyond that of the simple watch wearer, especially by continuing to follow the market and its evolutions.

The beauty of investing in watches is that - except in exceptional cases - you can wear your investment on your wrist and enjoy it, which is challenging to do with a bunch of gold coins or bearer certificates of deposit.

Main Takeaways

As you may have realized, investing in watches is not as simple as many investment gurus would have you believe. On the contrary, it is a complex field fraught with danger, especially now that the market is flooded with replicas, clones, and frankens, making everything much more difficult.

If you want to jump into the field of timepiece investing, and develop a watch collection, we recommend that you develop your skills and knowledge, and lean on a trusted professional who can guide you. If at all possible, avoid the easy enthusiasms and great bargains that you will periodically find along your way: remember that free cheese can usually be found in mousetraps.

This article is NOT an investment and/or financial recommendation in anyway. Before making any investment you should consulted and get an advice of the certified investments professionals.

The Davosa-USA.com website is NOT affiliated in any way with Audemars Piguet, Franck Muller USA, Inc. Richard Mille or Richemont Companies, Seiko, or any other brand which is not Davosa Swiss. Rolex is a registered trademark of Rolex USA. Davosa-USA website is not an authorized dealer, reseller, or distributor for Rolex and is in NO WAY affiliated with Rolex SA or Rolex USA or any other brand besides Davosa Swiss. |